“Can I transfer an Amazon account to a new owner?”

There is a misconception among sellers that it is non-compliant to transfer an Amazon account. Despite common belief, Amazon’s policy suggests that a new owner of a brand or company is required to create a new account.

However, this blog post aims to present factual information that dispels this misconception. Continue reading to learn more about the following:

- Account Ownership and Control

- Update Account Details After Change of Ownership

- Address Legal Matters

- Transfer Inventory

- Multiple Account Management

Be sure to read until the end to explore this bonus content: Solutions To The Problems Encountered When Buying or Selling Amazon Accounts

How To Transfer An Amazon Account: Account Ownership and Control

Amazon’s Policies on Account Transfer

Seller accounts generally cannot be transferred. These accounts grant sellers access to essential tools and resources for product listing and order management, along with account activity history and buyer feedback.

Every Amazon seller is required to possess a seller account and abide by an agreement with Amazon, outlining the terms for listing and selling products. In the event of a change in business ownership, the new owner must create a new seller account.

Amazon’s policy on account transfers is not explicitly revealed, emphasizing the need for external guidance based on practical experience.

It is exactly not allowed to change account ownership. When you need to transfer an Amazon account, just make sure that do it the right way.

Scenarios Of Account Ownership Change

Here are the common instances when an Amazon Seller Central account may change ownership:

Business Acquisition or Merger:

- When one company acquires another, the Amazon accounts associated with the acquired business typically transfer to the new owner.

- This ensures continuity of operations and brand presence on Amazon.

Change in Legal Entity:

- If a business restructures or changes its legal form (e.g., from sole proprietorship to LLC), it may need to update the ownership information on its Amazon account to reflect the new legal entity.

- This maintains compliance with Amazon’s policies and accurate reporting.

Sale of Assets:

- If a business sells specific assets, including its Amazon account, the new owner would need to assume control of the account and update the ownership details.

- This transfers all associated rights and responsibilities to the new owner.

Inheritance:

- If the original account owner passes away, the account ownership may transfer to their heirs or designated beneficiaries, as per legal inheritance laws.

- This ensures the continued operation of the business and preservation of its assets.

Partnership Dissolution:

- When a business partnership dissolves, the ownership of the Amazon account may need to be reassigned to one of the partners or a new entity entirely.

- This depends on the terms of the partnership agreement and any legal settlements.

Brand Expansion with New Accounts:

- Some clients opt to add new brands to their existing Amazon accounts, seeking to broaden their market presence and cater to different customer segments.

Strategic Planning for Brand Sale:

- Clients may engage in account transfers with the strategic goal of selling their brand in the future.

- This scenario involves preparing the Amazon account for a potential sale, requiring careful consideration and planning.

Understanding Account Ownership

To understand account ownership, we need to review User Permissions in Seller Central.

You will use a single email address when setting up a Seller Central account and this email should not be used in any other accounts, else you will violate Amazon policies and risk suspension.

With an active Seller Central account, you will have exclusive access to the account tools and features is granted to you. You have the ability to grant access to additional individuals, such as employees, co-owners, or contractors, by configuring your user permissions.

How To Transfer An Amazon Account: Update Account Details After Change of Ownership

Stephen PopeAccount transfers are allowed. Safe to make the changes.

Let’s take a look at this scenario:

Transitioning Ownership in an Amazon Business Account

Seller A and Seller B jointly initiated an Amazon business venture under the LLC, E-Commerce Dynamics. Over time, Seller A has taken on the primary responsibility, becoming the sole operator. Now, Seller A faces the challenge of transferring complete ownership and control of the Amazon account from Seller B to themselves.

Current Situation:

LLC Ownership

- E-Commerce Dynamics is the registered LLC, initially established jointly by Seller A and Seller B.

Sole Ownership

- Seller A is now the sole owner and primary operator of the Amazon business.

Ownership Details Challenge

- The user permissions display Seller B’s name in the email, and the bank account is also under Seller B’s name.

Challenges Faced:

Email Discrepancy

- The email address associated with user permissions reflects Seller B’s name, creating a potential inconsistency in account ownership details.

Bank Account Name Mismatch

- The bank account linked to the Amazon business is registered under Seller B’s name, raising concerns about compliance with Amazon policies.

Concerns:

Account Transfer Hesitation

- Seller A is concerned about potential account shutdowns, as Amazon’s policies are unclear about direct “account transfers.”

Possible Solutions:

Email Address Update:

Strategy

- Create a new, dedicated email address (e.g., admin@ecommercedynamics.com) exclusively for Amazon operations. This email should not be associated with any other Amazon account.

Implementation

- Update the main admin email under user permissions to the new, unique email address associated with the LLC.

Bank Account Transition:

Strategy

- Safe timing for bank Changes.

Implementation

- Changing bank account details right before a deposit can trigger a 48-hour account lockdown. To prevent this, it’s suggested to make these changes three to five days before a deposit.

Do you want to know more about additional information about confidently managing your account’s bank details? Make sure to read 5 Tips for Amazon Sellers: Managing Legal Entities with Confidence.

Key Things To Remember:

- The main admin email is the one that does not have the delete option in Seller Central’s User Permissions page.

- It is possible to change the admin email of the account you acquired, but be sure to use an email that has not been used in other accounts (either as an admin or a secondary user)

- Once the admin email address has been changed, ensure that your purchase agreement states that the other party from whom you bought your new account will retire the old email address and will not use it on another Amazon account. Otherwise, this may result in a suspension issue.

How To Transfer An Amazon Account: Address Legal Matters

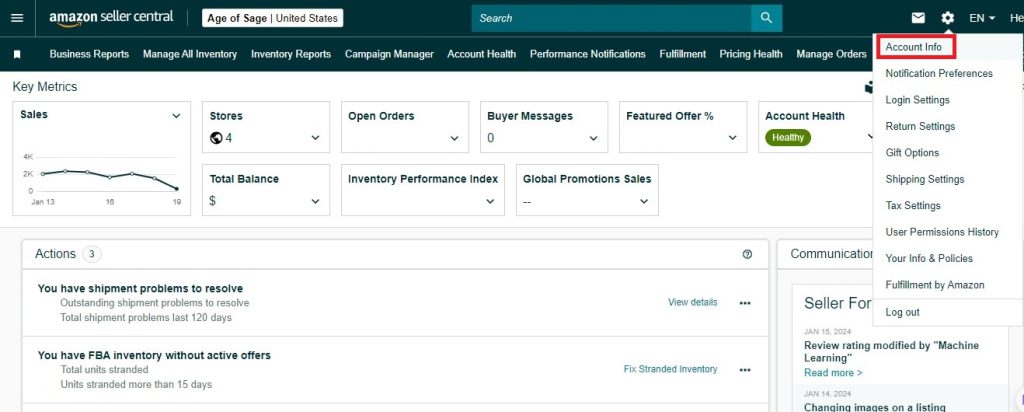

In the featured video above, Steven touched the legal issues involved in Amazon account transfers. What comes after updating the bank account details is retaking the tax interview within Seller Central.

How To Retake Tax Interview:

- Select “AccountInfo” from the Settings in Seller Central.

2. Scroll down the page to look for “Tax Information.”

3. Click Update Tax Information.

4. Respond to all the questions to finalize the tax interview. Ensure to furnish your e-signature to expedite the processing.

EIN (Employer Identification Number) Considerations According to Steven:

- One EIN per account.

- If transferring within accounts, where EIN remains the same, there is no need for a second EIN.

How To Transfer An Amazon Account: Transfer Inventory

Transferring inventory directly from Fulfillment by Amazon (FBA) to another account is not a straightforward process. In FBA, direct transfers between accounts are not allowed. If you’re acquiring an account and intend to move its inventory to another, you have two main options:

- Sell Down on the Old Account and Ship New Products to the New Account:

Gradually sell the existing inventory on the original account.

Introduce new products to the destination account.

2. Transfer Inventory Back to a Warehouse from the Old FBA Account:

Move the inventory from the old FBA account back to a warehouse.

Ship the products from that warehouse to the new account.

While the second option can be cumbersome, involving shipments from various warehouses, it might be the only choice for those seeking a swift transfer. However, this process is not recommended due to its complexity and potential challenges.

Key Things To Remember:

- Be cautious with inventory transfers, as selling the same item on two accounts simultaneously violates Amazon’s policy.

- While instances of suspension for this violation are rare, it’s advisable to limit such activity to a short period, preferably around 90 days, to avoid any complications or red flags with Amazon.

- Note that some sellers have engaged in such practices without facing consequences, but adherence to terms and conditions is always recommended.

Here are some related removal order videos to watch:

How To Transfer An Amazon Account: Multiple Account Management

As your business grow, you might end up acquiring more accounts and you need to know the best way to effectively manage them. There are two possible management options: ine is through a single, large FBA account and the other is through several small FBA accounts.

One Large FBA Account vs Multiple Smaller FBA Accounts

One Large FBA Account

Advantages:

- Economies of Scale: Capitalize on economies of scale, leading to reduced shipping costs and improved negotiation power with suppliers.

- Greater Brand Recognition: Build a stronger brand identity and attract a larger customer base through a large account.

- More Data Insights: Generate a significant amount of data, providing valuable insights for making informed business decisions.

Disadvantages:

- More Risk: Higher susceptibility to risks like product recalls or policy changes on Amazon.

- More Complexity: Managing a large account can be more complex, particularly for less experienced FBA sellers.

- More Resources Required: Demands additional resources such as staff, software, and inventory.

Multiple Smaller FBA Accounts

Advantages:

- Less Risk: Diversify products and markets, reducing susceptibility to risks compared to a single large account.

- Easier to Manage: Smaller accounts are generally easier to manage, especially for those new to FBA selling.

- More Flexibility: Enjoy greater flexibility to experiment with various products and strategies.

Disadvantages:

- Higher Costs: Smaller accounts may incur higher costs, including shipping and advertising expenses.

- Less Brand Recognition: Limited brand recognition compared to a larger account.

- Less Data Insights: Generate less data, potentially making it challenging to make well-informed business decisions.

Considerations for Decision-Making:

- Business Experience Larger accounts managed by a full-service Amazon agency may be suitable for experienced sellers who can handle the complexity. Smaller accounts may be preferable for newcomers seeking simplicity.

- Risk Tolerance: Businesses with a higher risk tolerance may opt for a large account despite potential risks. Those with lower risk tolerance may find security in managing smaller, diversified accounts.

- Resource Availability: Consider the availability of resources such as staff, software, and inventory when choosing between large and small accounts.

- Strategic Goals: Align the choice with your strategic goals, whether it’s building a strong brand, experimenting with flexibility, or minimizing risk.

Ultimately, the decision depends on individual circumstances, goals, and the capacity to manage the associated complexities and resources.

Recommendations on Choosing Between a Single Large Account and Multiple Small Accounts

Opt for a Single Large Account If You Want Or Need:

Easier Management:

- Scenario: If you value simplicity and find it easier to manage one comprehensive account.

- Example: Individual entrepreneurs or businesses with limited complexity.

Cost and Accounting Efficiency:

- Scenario: When minimizing fees and accounting issues is a priority.

- Example: Businesses seeking streamlined financial management.

Unified Tax Structure:

- Scenario: If all brands operate under the same tax infrastructure.

- Example: Businesses with a unified tax structure across their brands.

Consider Multiple Small Accounts For:

Diverse Partnerships:

- Scenario: If you have different partners with varying tax infrastructures.

- Example: Businesses with distinct partners for each brand.

Brand-Specific Tax Considerations:

- Scenario: When each brand requires a unique tax approach due to specific considerations.

- Example: Companies with brands catering to different markets or demographics.

Risk Mitigation and Experimentation:

- Scenario: If you prefer diversifying risk and experimenting with different products and strategies.

- Example: Startups or businesses in the early stages of market exploration.

Distinct Brand Identities:

- Scenario: When each brand has a unique identity and requires separate management.

- Example: Companies managing multiple brands with different target audiences.

Avoidance of Drop Shipping Concerns:

- Scenario: If engaging in drop shipping, it may be beneficial to have multiple accounts to avoid suspension risks.

- Example: Businesses adopting drop shipping practices within compliance boundaries.

General Guidelines:

Private Labelers and Mini Aggregators:

Scenario: For private labelers and those acting as mini-aggregators, having multiple accounts is generally safe and permissible.

Transfer and Purchase Considerations:

Scenario: Buying or transferring accounts is acceptable within Amazon’s policies, providing flexibility for business strategies.

Caution with Drop Shipping:

Scenario: Drop shippers should be mindful of terms and conditions, as engaging in multiple accounts may lead to suspension risks.

Cautions to the Wind Scenarios:

Scenario: While generally permissible, businesses should exercise caution in specific situations, such as varied tax structures or partnerships.

Expand your learning by watching these related videos:

Can I transfer an Amazon account to a new owner?

In summary, transferring an Amazon account to a new owner is a nuanced process with potential pitfalls. As discussed by Steven Pope, key steps involve changing the main admin email, managing inventory challenges, and navigating bank account transfers.

Attention to detail, clear communication, and adherence to Amazon policies are crucial throughout this undertaking. While the process may lack transparency, Steven’s insights provide valuable guidance for a successful transfer.

Whether consolidating brands or planning for future sales, sellers can navigate this intricate process by leveraging best practices outlined in this comprehensive guide provided by an Amazon agency.

Bonus: Problems Encountered When Buying or Selling Amazon Accounts

For Buyers:

Scams and Fraud:

- Problem: Fake or inactive accounts, stolen accounts, inflated revenue or reviews, hidden liabilities.

- Solution: Thorough due diligence, background checks on the seller, independent account verification, escrow services.

Compliance Issues:

- Problem: Violating Amazon’s Terms of Service, account suspension, difficulty transferring ownership.

- Solution: Understanding Amazon’s policies, consulting with legal and tax professionals, ensuring proper paperwork and transfer procedures.

Hidden Costs and Liabilities:

- Problem: Unexpected tax issues, inventory discrepancies, outstanding debts or legal claims associated with the account.

- Solution: Detailed financial audits, clear contracts outlining transfer of liabilities, professional financial guidance.

Loss of Control and Reputation:

- Problem: Difficulty building credibility on an established account, limited access to historical data, dependence on previous owner’s goodwill.

- Solution: Transparency with customers, focus on branding and building trust, proactive communication with Amazon during transfer process.

For Sellers:

Loss of Income and Opportunity:

- Problem: Potential account suspension during transfer, disruption to ongoing business operations, delayed access to funds.

- Solution: Planning the sale well in advance, ensuring seamless transition period, utilizing escrow services for secure payment holding.

Legal and Tax Implications:

- Problem: Capital gains tax on account sale, contract disputes, legal ramifications of non-compliance with Amazon policies.

- Solution: Professional tax and legal advice, clear contracts outlining terms and responsibilities, adhering to Amazon’s regulations.

Security Risks and Fraud Concerns:

- Problem: Sharing sensitive account information, potential for identity theft, risk of account hijacking after sale.

- Solution: Secure communication channels, strong passwords and two-factor authentication, clear communication with buyer about access limitations.

Reputational Damage:

- Problem: Negative feedback from disgruntled buyers, association with potential misuse of the account by subsequent owners.

- Solution: Disclose account sale transparently, monitor post-sale activity, consider brand protection measures.

Additional Tips:

- Never rush into buying or selling an account. Do your research, ask questions, and understand the risks involved.

- Utilize reputable platforms and escrow services. Seek professional advice if needed.

- Transparency and open communication are keys throughout the process.

- Always prioritize legal and financial compliance.