So you’ve received an Amazon re-verification email that the platform has been recently sending to many. At first glance, it seems that what it’s asking you to do is easy and straightforward. However, as you read further, you find it’s far from the simple process you expected.

You know that failure to re-verify your account is out of the question. At least that’s one question less for you! In this blog post, we’ll try to cover some of the questions that sellers might ask when they prepare the requirements for Amazon seller account re-verification.

Why is Amazon Re-Verification Important?

Watch our CEO, Steven Pope, as he discuss about the Seller Identity Verification

What do you need to re-verify your account?

Amazon’s re-verification email enumerates the following items they are looking for:

- Information about your business

- Information about your identity

- A government-issued photo ID

- A bank account or credit card statement

- A business license, if applicable

What information will I need to prepare for these questions?

Other equally important details that Amazon requires are:

- Business type (sole proprietorship, LLC, corporation, etc.)

- Information about the products you sell, including brand name, manufacturer, and supplier

- Details about your supply chain and sourcing practices

- Proof of compliance with applicable laws and regulations

- Tax identification number (such as an EIN or VAT number)

- Contact information for the person responsible for the account and any authorized representatives

- Any additional information or documentation that Amazon may require to verify your account

Do I enter information in Seller Central, upload the documents, or verify the Items?

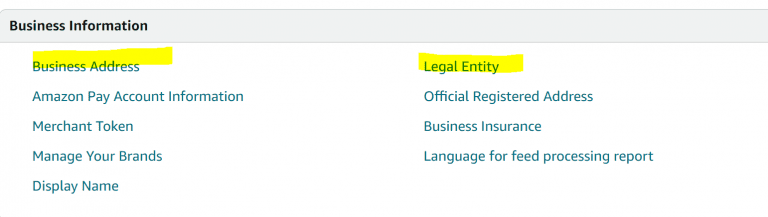

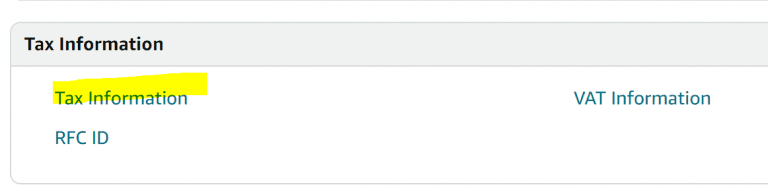

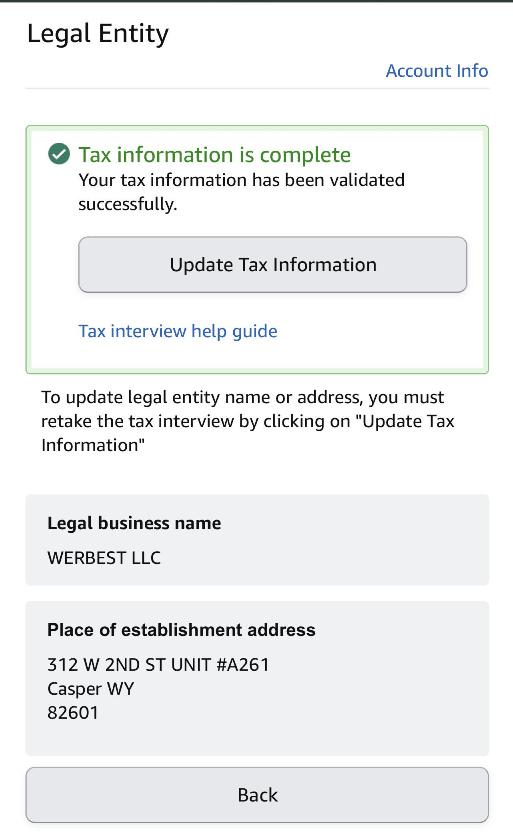

Be it initial verification or Amazon re-verification, you can expect to enter the required details into the specific pages in Amazon Seller Central. In updating your tax information, for example, you can retake the tax interview (like what the image below shows) by doing the following:

- Go to Settings > Account Info.

- Click Tax Information.

- Click Update Tax Information at the bottom of the page.

- Answer all the questions and remember to provide your e-signature for faster processing.

What documents do I need to upload?

- Proof of identity for the authorized representative(s) associated with the account, such as a passport, driver’s license, or government-issued ID

- Proof of address for the authorized representative(s), such as a utility bill or bank statement

- Invoices or purchase orders for products sold on Amazon.

- Proof of compliance with applicable laws and regulations, such as product safety certifications or permits

- Brand authorization documentation from manufacturers or suppliers

- Images or descriptions of the products sold on Amazon.

- Business registration or tax documentation, such as a business license or tax return.

What tips or guidelines can I follow?

- Scan the document so all the edges of the paper are visible.

- White paper is best scanned against a dark background to show the borders.

- Verify that the name of the company or person matches what is entered in Seller Central and the document. When in doubt, update the account to match. (It can always be updated later.)

- If the account/bank statement is in the legal name, that is ideal.

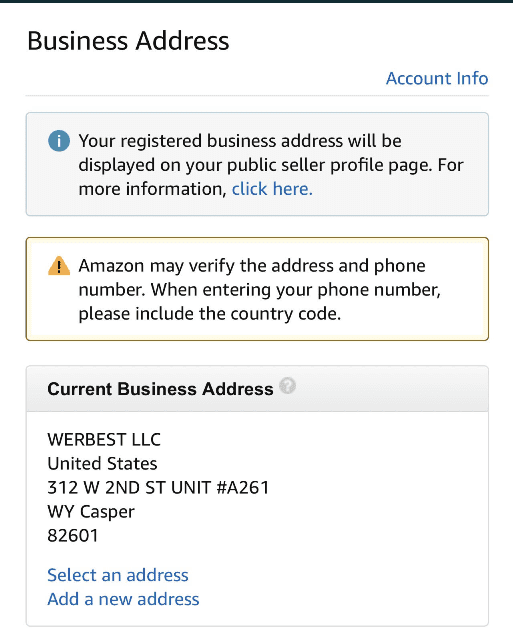

- Make sure the tax interview and the business address are synced and match the documents.

What makes the process challenging?

- Scan the document so all the edges of the paper are visible.

- White paper is best scanned against a dark background to show the borders.

- Verify that the name of the company or person matches what is entered in Seller Central and the document. When in doubt, update the account to match. (It can always be updated later.)

- If the account/bank statement is in the legal name, that is ideal.

- Make sure the tax interview and the business address are synced and match the documents.

Where can I get additional help? At MAG, of course!

Follow these steps and tips above and if you still have struggles, you might want to book a video screen share coaching session to locate the issue and resolve it on the call: myamazonguy.com/coaching